How Covid-19 is Impacting Discounts for Lack of Marketability - Some Data to Consider

Posted By: Admin MergerShark on April 08 2020

How Covid-19 is Impacting Discounts for Lack of Marketability - Some Data to Consider

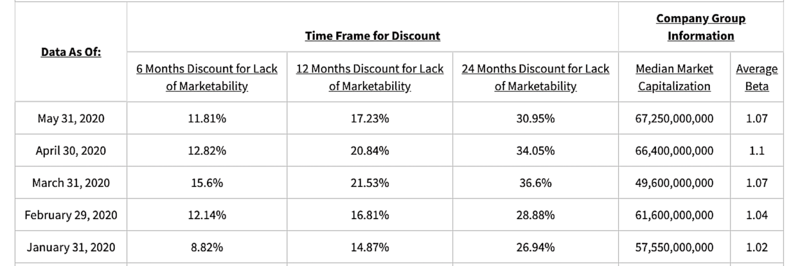

In a matter of weeks, the Covid-19 pandemic disrupted the world’s economy, including publicly traded stock markets and the functioning and profitability of many privately held businesses. As business valuation professionals, our clients often look to us during times of crisis and emergency to provide guidance. With the increased public market volatility the risks of being a private equity owner have now also increased. Any implicit discount for lack of marketability (DLOM) applied to a business valuation should be higher to reflect the increased discount we are witnessing in the publicly traded markets. It is more important now than ever to have market-based DLOM data to use in any valuation reports or consultations for your clients. The MergerShark team wanted to share with you our January 2020 through May 2020 Lack of Marketability discounts, as well as data on how the discounts have recently changed. We are providing this as a thank you for the work you are doing right now to help navigate your clients through this uncertain time.

The MergerShark proprietary Discount for Lack of Marketability model calculates discounts from long term equity anticipation (LEAP) calls and puts using a proprietary group of 30 large publicly traded companies. The 30 large capitalization publicly traded companies we use cover a broad range of industries and typically have a beta slightly over one.

Our March 2020 Lack of Marketability discounts were 15.60%, 21.53% and 36.60% for the 6, 12 and 24 months periods respectively. By comparison, the same January discounts were 8.82%, 14.87% and 26.94%. Over the course of two months the 6, 12 and 24 months Lack of Marketability discounts increased by 76.87%, 44.79% and 35.86% respectively.

As the stock market rebounded slightly in April, the discounts remained elevated, but settled back somewhat compared to March. Our April 2020 Lack of Marketability discounts were 12.82%, 20.84% and 34.05% for the 6, 12 and 24 months periods respectively. Our April 6, 12 and 24 months Lack of Marketability discounts reflect a 45.35%, 39.58% and 26.39% respective increase from January discounts.

Our May 2020 6, 12 and 24 months Lack of Marketability discounts were 11.81%, 17.23% and 30.95%. Our May 6, 12 and 24 months Lack of Marketability discounts reflect a 33.90%, 15.87% and 14.88% respective increase from January. However, our May 2020 6, 12 and 24 months Lack of Marketability discounts reflect a 24.29%, 19.97% and 15.43% respective decrease since March, when the first significant spike in the discounts was noted.

Clearly, the increased discounts beginning in February 2020 and continuing into May are reflective of higher actual market risk. This increased volatility and risk is also reflected in the average beta of our public company group, which increased from 1.02 in January to 1.07 in March, 1.10 in April and 1.07 in May. The stock market rallied in April and May over optimism about reopening the economy in certain areas and the rollout of the unprecedented U.S. stimulus program. However, our April beta is the highest beta we have had in our model since January 2018, indicating high volatility and unpredictability, with markets moving often significantly with new information and political action.

Over a longer period of time, from the fall of 2014 to March 2020, our median historic 6, 12 and 24 months Lack of Marketability discounts are 8.96%, 14.73% and 26.79%. Comparing the median historic discounts to the March 2020 discounts, the March Lack of Marketability discounts increased by 74.11%, 46.16% and 36.62% respectively. Comparing the median historic discounts to the April 2020 discounts, the April Lack of Marketability discounts increased by 43.08%, 41.48% and 27.10% respectively. Comparing the median historic discounts to the May 2020 discounts, the May Lack of Marketability discounts increased by 31.81%, 16.87% and 15.53%.

Our market based DLOM results can be used as a starting point for determining an appropriate discount to apply to your subject company. You can then apply your expertise to examine the unique value creation factors and risk factors your subject company exhibits. For further reading on this matter, you can reference the article “How to Determine a Discount for Lack of Marketability: Introducing the Predictive Illiquidity Process” by MergerShark’s founder, Brian K. Pearson, CPA/ABV/CFF/PFS, ASA, published in The CPA Journal:

https://www.cpajournal.com/2019/12/11/how-to-determine-a-discount-for-lack-of-marketability/

As a reminder, the MergerShark database was built to be an all in one, affordable business valuation database. The database includes over 17,00 public and private transactions with multiples, discounted cash flow information, discount for lack of control and discounts for lack of marketability information and much more. It was built by a business valuation professional for fellow BV professionals.

We offer a free one day trial subscription, if you are interested. You can sign up for your free day pass here.